FDIC-Insured

- Backed by the full faith and credit of the U.S. Government

To report a lost or stolen debit card please call 407.545.2662 during normal operating hours. After hours, please call 1.800.500.1044 immediately or access www.visa.com

Our Bank Routing and Transit Number is: 063114661

You will be linking to another website not owned or operated by Cogent Bank. Cogent Bank is not responsible for the availability or content of this website and does not represent either the linked website or you, should you enter into a transaction. The inclusion of any hyperlink does not imply any endorsement, investigation, verification or monitoring by Cogent Bank of any information in any hyperlinked site. We encourage you to review their privacy and security policies which may differ from Cogent Bank.

If you "Proceed", the link will open in a new window.

You are leaving Cogent Bank and going to Cogent Private Wealth, a boutique advisory firm offering comprehensive financial planning and investment management services. Some of their products are NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY; NOT GUARANTEED BY THE BANK; and MAY LOSE VALUE.

If you "Proceed", the link will open in a new window.

Please note that by clicking on this email address, you are leaving the Cogent Bank website and accessing an external email platform. Cogent Bank has no control over the content of any communications contained within this platform and cannot be held responsible for any information exchanged. We caution users to be careful when sharing any personal or sensitive information via email, as it may be intercepted or misused by third parties. By using this email platform, you accept full responsibility for any risks that may arise from its use.

If you "Proceed", the link will open in a new window.

At Cogent, we believe banking is personal. Our name means “come together” and we are committed to the communities we serve. Since Hurricane Ian made landfall in Florida on September 28th, we have supported organizations that provide critical relief to Floridians impacted by the hurricane. We know that many people from within the Sunshine State and across the country also want to help. Unfortunately, scammers see tragedy as opportunity, hoping to siphon off some well-intentioned donations. Therefore, it’s important to know how to spot the scams that often follow natural disasters. In this article, we’ll share some tips on natural disaster scams to help you make sure your hard-earned money goes to help those who need it most.

As of this writing, Hurricane Ian is expected to become one of the most consequential hurricanes in recent memory. More than 100 people have died, with most of the death toll coming from Florida, particularly Lee County. The financial cost is estimated at $60 billion plus in Florida alone, second only to the cost of the damage caused by Hurricane Katrina in 2005. Unfortunately, only 18% of homes in Florida have flood insurance, meaning that some homeowners will have to reach into their own pockets to rebuild in the wake of Ian.

Before you make a donation to help Hurricane Ian’s victims, learn how to tell a reputable charity from a scam.

Hurricane disaster scams are part of every hurricane season. You may receive solicitations for donations via phone call, text message, or email. Hurricane disaster relief fraud can also circulate on social media. Protect yourself from fraud by following these tips:

If you’re looking for ideas of where to donate to disaster relief, here’s a list of nationally recognized charities currently working with the people and communities impacted by Ian.

Scammers can linger after a natural disaster, so stay vigilant for the next several months to avoid Hurricane Ian relief scams. While these fraud attempts may be more prevalent right now, they will likely continue for the remainder of the year. Here are a few ways to keep an eye out for scams:

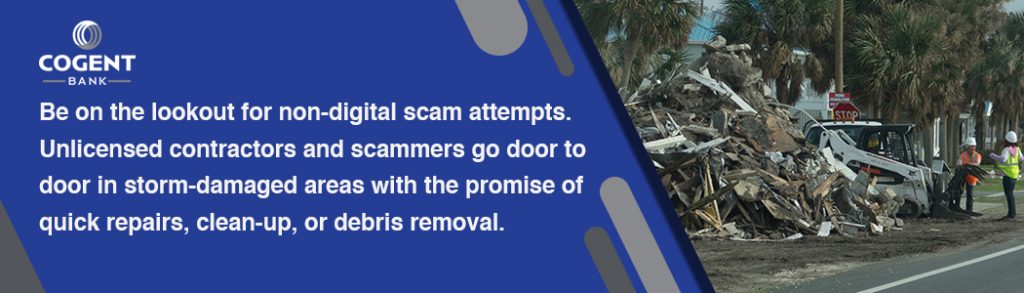

In addition to charity fraudsters preying on Americans’ generosity, Florida homeowners and residents directly impacted by the hurricane need to watch out for these kinds of scams:

Finally, you can protect yourself by learning to identify phishing emails. After all, this is still the most common method of scamming people. Phishing, a play on the word fishing, refers to emails and other messages designed to trick the reader into believing it is a legitimate message. Emails, in particular, can be convincingly designed with official-looking logos that might trick you into thinking the message comes from a government agency, financial institution, or well-known company.

At Cogent Bank, we are dedicated to Moving You Forward. If you have questions about your account, Florida disaster relief scams, or anything else, call us to set up an appointment or reach out to your Relationship Manager. We also invite you to follow our blog for the latest happenings and knowledge from our team.

The information contained herein is for informational/educational purposes only. The views and opinions expressed in this document may be those of the individuals and may not necessarily reflect those of Cogent Bancorp and its subsidiaries and affiliates, or the entities they may represent. Content contained herein may be used in connection with the advertising and/or marketing of products offered by Cogent Bank or Cogent Private Wealth. The material is not intended to provide or substitute for legal, tax, or financial advice or to indicate the availability or suitability of any Cogent Bank product or service. You should consult with a legal, financial, tax, or other appropriate professional(s) for your specific needs and/or objectives before making any decisions.