FDIC-Insured

- Backed by the full faith and credit of the U.S. Government

To report a lost or stolen debit card please call 407.545.2662 during normal operating hours. After hours, please call 1.800.500.1044 immediately or access www.visa.com

Our Bank Routing and Transit Number is: 063114661

You will be linking to another website not owned or operated by Cogent Bank. Cogent Bank is not responsible for the availability or content of this website and does not represent either the linked website or you, should you enter into a transaction. The inclusion of any hyperlink does not imply any endorsement, investigation, verification or monitoring by Cogent Bank of any information in any hyperlinked site. We encourage you to review their privacy and security policies which may differ from Cogent Bank.

If you "Proceed", the link will open in a new window.

You are leaving Cogent Bank and going to Cogent Private Wealth, a boutique advisory firm offering comprehensive financial planning and investment management services. Some of their products are NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY; NOT GUARANTEED BY THE BANK; and MAY LOSE VALUE.

If you "Proceed", the link will open in a new window.

Please note that by clicking on this email address, you are leaving the Cogent Bank website and accessing an external email platform. Cogent Bank has no control over the content of any communications contained within this platform and cannot be held responsible for any information exchanged. We caution users to be careful when sharing any personal or sensitive information via email, as it may be intercepted or misused by third parties. By using this email platform, you accept full responsibility for any risks that may arise from its use.

If you "Proceed", the link will open in a new window.

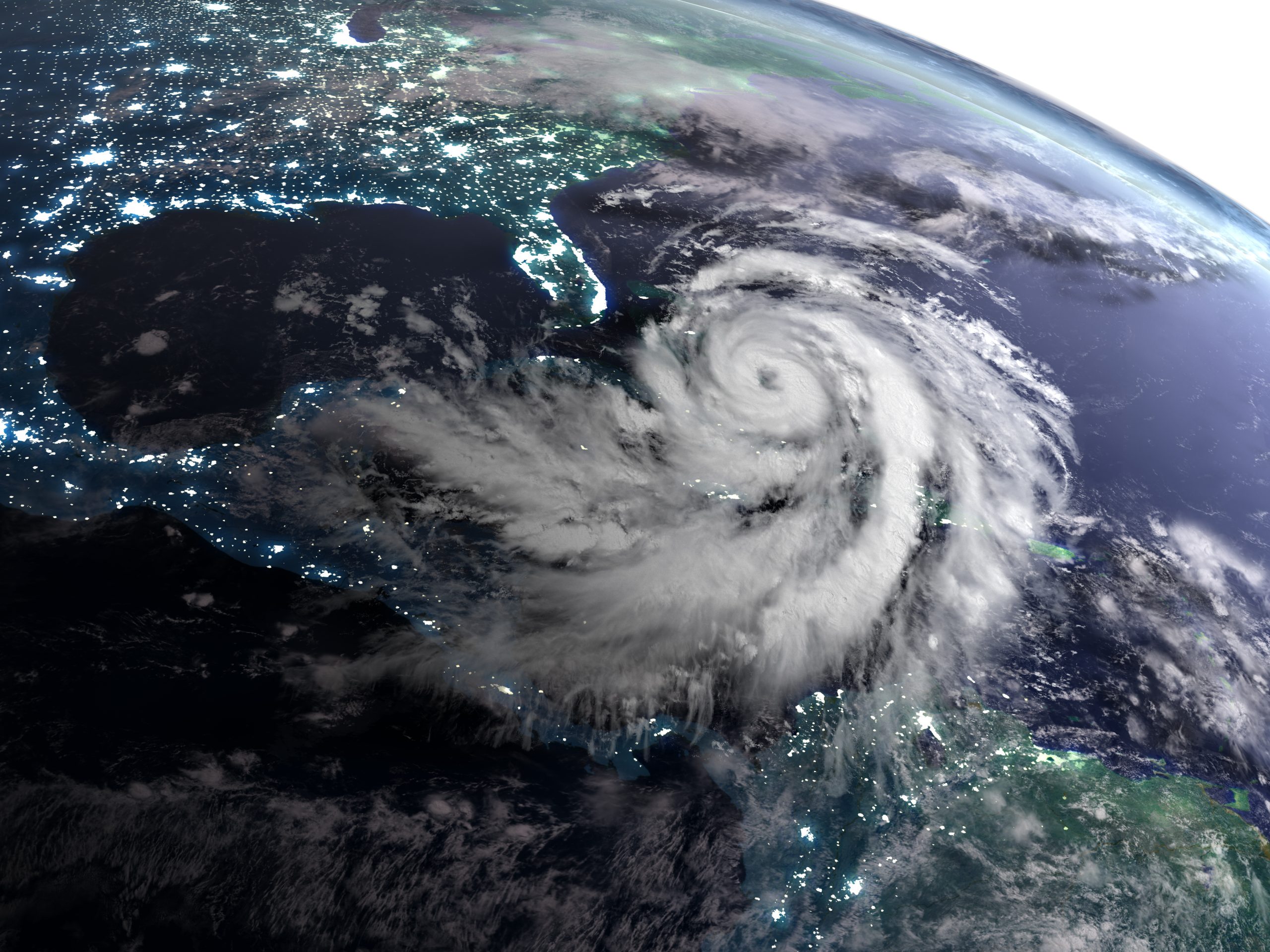

The National Oceanic and Atmospheric Administration (NOAA) predicts the 2025 Atlantic hurricane season will be stormier than usual, with an estimated 13 to 19 named storms, at least six hurricanes, and three to five of them could be major hurricanes with winds of 111 mph or more. The season runs from June 1 to Nov. 30.

As a locally owned and operated bank in Florida, we want our customers to know how to prepare for a hurricane at home and at their business so everyone can get through the storm season as safely as possible. Of course, many hurricane safety tips for businesses also apply to families, so we’ll start by offering general things to consider as part of your hurricane preparedness checklist.

Storm readiness for families and businesses starts with considering the kinds of risks you face. With the Federal Emergency Management Agency’s flood map service, you can enter the addresses of your home and business to find out the flood zone for these locations. This gives you an idea of how high the water might reach during a storm surge or extreme rain, so you can consider how much of your property you might need to evacuate or move to higher ground.

Take a close look at your personal and business properties. You might ask a contractor or a structural engineer to inspect your property for any changes you may need to make. Your inspection list should include your walls, sheathing, windows, and doors. Secure sizable items such as desks, chairs, and filing cabinets.

On the outside, make sure your roof is in good shape and that any equipment you keep outside is secure. If any tree branches are overhanging your roof, consider having them removed. Your gutters should be free of debris, and downspouts should direct rainwater away from the building. Many Florida residents and businesses have storm shutters or have sheets of plywood on hand for protecting windows and doorways.

Make sure you know how to turn off your electrical and natural gas supplies, so you can do so if you must evacuate. This could help you avoid gas leaks, fires, and power surges during and after a storm. You might also close the valves to your sewer lines, if you can, to keep them from backing up into your property.

Other emergency items you might need for your home or business include:

• Sandbags

• Cleaning supplies and trash bags

• Hoses and portable pumps

• An emergency generator and fuel

• Tarps, ropes, bungee cords, and duct tape

• Building schematics that include electrical and plumbing lines

Some homeowners and businesses go without flood insurance unless it’s required by a mortgage or a business loan, but you may need both property insurance and flood insurance in case of a storm. Property insurance covers damage from wind, rain, and other risks. You should make sure it also covers damage from wind, hail, and wind-driven rain. Flood insurance covers physical damage that’s directly caused by a flood, such as a storm surge or a river overflowing its banks.

One of the reasons why having both property and flood insurance is so important is that after a storm, it can be hard to determine how much of the damage would apply to either policy.

Imagine if hurricane-force winds damaged your roof, which resulted in rain damage, while a storm surge pushed floodwater into your building. If you only had flood insurance, it would cover the floodwater damage, but not the roof and rain. If you only had property insurance, it would cover the roof and rain damage, but not the storm surge.

Because of the anti-concurrent causation clause, if you experience property damage from two different causes, and you’re only insured for one of them, you could be facing the rejection of your entire claim.

You should have easy access to all your important documents, such as financial records, insurance information, personal identification, and records of major purchases for your home or business. These should be ready to go, in case you must evacuate, and you should have more than one copy of them. You might digitize these records and store them in more than one place.

If you file a claim after a storm, the process will be much easier if you have a list of your most expensive personal items or your business assets and equipment. This should include as much detail as possible such as the make, model, serial number, purchase date, and price. Pictures and videos of these items would also be useful.

Your hurricane evacuation planning should involve everything you need to secure your home, your workplace and to keep everyone safe. Hold evacuation drills, with everyone given a checklist of how they’re going to secure your property and what they’ll bring with them—just make sure it’ll all fit into your vehicle, so you don’t have to make a last-minute decision on what to take.

A business hurricane preparedness plan should include contact information for all your employees, including friends and family members, and the details on where everyone will be riding out the storm. Everyone should have more than one option for how they will evacuate and the routes they could take.

Business owners may have equipment, inventories, and business vehicles to look after. Would any of your employees be willing to take such business property with them when they evacuate? Could you loan out any business vehicles to your employees so they could evacuate with business property and their personal belongings?

If you must evacuate because of a hurricane or other disaster, there are a couple of ways to find emergency shelter:

• The American Red Cross has a webpage where you can search for open shelters and disaster relief services.

• Search for disaster relief and other services through The Salvation Army.

• You can also find shelters by texting SHELTER and your ZIP Code to 43362.

During hurricane season, many Florida residents have a “go bag” of essential items that they could grab and take with them in case of an emergency. It might include things like a few days’ worth of clothing and an emergency supply of cash, but there are other items to consider putting on your list and to have them ready to grab and go. These include:

• A hard drive or thumb drive with essential documents and data.

• Cell phone chargers and power banks for your electronic devices.

• Medicines and prescriptions.

• Ready-to-eat nonperishable food.

• Drinking water (at least one gallon per person, per day).

• A battery-powered radio.

• Flashlights and extra batteries.

• First-aid kits, hand sanitizer, and other hygiene products.

• Paper plates, eating utensils, and a manual can opener.

• Fuel and gasoline for your vehicles and/or a cook stove.

Storm readiness for families and businesses involves more than just local weather reports. The Florida Division of Emergency Management operates the AlertFlorida notification system, where you can sign up for notifications affecting your area. The National Weather Service also offers free Wireless Emergency Alerts that you can subscribe to, and NOAA’s National Hurricane Center offers information on active storms and forecasts.

After a storm has passed, it’s important to wait until the authorities have issued an “all clear” notice that it’s safe to do so. The National Weather Service reports that just six inches of fast-moving water can knock over an adult, just twelve inches of water can carry away most cars, and two feet of water can carry away trucks and SUVs. Even if the water doesn’t seem that deep, a collapsed roadway could be hiding underneath.

As you return to your property, watch out for downed power lines and signs of structural damage on the outside before entering a building. If you’re not sure, you may need a building inspector or a structural engineer to verify if it’s safe. You also need to make sure your electrical system is dry, and that power is available before turning your electricity back on. If your electrical system may have been damaged, it is wise to have an electrician inspect it before turning it on.

Take pictures to document any damage before you start cleaning up and contact your insurance company to initiate a claim. You should avoid major repairs until you meet with an insurance adjuster, but you could take steps to secure and protect your property, such as putting a tarp on the roof or boarding up broken doors and windows.

After hurricanes and other disasters, FEMA operates Disaster Recovery Centers (DRCs) where you can learn about disaster assistance programs. You can search for a FEMA recovery center online, or text DRC and your ZIP code to 43362.

You can also search for state and local resources for disaster relief at DisasterAssistance.gov.

The Small Business Administration (SBA) offers two kinds of disaster relief programs for those in federally declared disaster areas. These programs offer low-interest loans, and both payments and interest accrual can be deferred for 12 months.

Economic Injury Disaster Loans

• Economic Injury Disaster Loans provide small businesses, small agricultural cooperatives, and nonprofit organizations with loans to cover healthcare benefits, rent, utilities, and fixed debt payments.

Physical Damage Loans

Two types of physical damage loans are available for financial losses from disasters that aren’t fully covered by insurance. Any proceeds from your insurance for these losses could be deducted from your loan amount.

• Home and personal property loans are available to homeowners, renters, nonprofit organizations, and businesses that suffered a property loss in a disaster that’s not fully covered by insurance and other sources. Homeowners can borrow up to $500,000 to replace or repair their primary residence. Renters and homeowners can borrow up to $100,000 to replace or repair personal property.

• Business physical disaster loans are available to businesses of any size and most nonprofit organizations. Loans of up to $2 million are available to cover disaster losses that aren’t fully covered by insurance. They can be used to repair or replace real property, machinery, equipment, inventories, etc.

Businesses face their own unique risks during disasters. In fact, about 25% of businesses failed to reopen after a disaster, according to the Federal Emergency Management Agency (FEMA).

Business insurance and disaster relief can only get you so far in recovering after a disaster. We mentioned property and flood insurance above, but you might also need business interruption insurance. Also known as business income insurance, it can cover part of your lost income and business expenses if you’re forced to close your business for a covered loss, such as property damage or a natural disaster.

We recommend that every individual, family, or business owner have an emergency fund that would cover three to six months’ worth of expenses, preferably in an interest-bearing account that you could easily access. You might also consider having a business line of credit that you could tap into whenever you need.

Your business recovery plan should consider:

• How long can you make payroll and pay your bills without income?

• What is your amount of insurance coverage do you have, and is it enough?

• Will you have to relocate, and how we you notify your customers and suppliers?

• Do you have enough supplies or alternative suppliers in case those you rely on have closed their business?

• How many of your employees will return after the storm, and what will their role be in helping you recover?

Ready.gov offers a comprehensive guide, Ready Business Hurricane Toolkit, to help develop a plan to keep your business viable, even in the event of a major disaster.

At Cogent Bank, we want to help all our local businesses and individual customers get through disasters as easily as possible. That’s why we offer digital banking through our online portal and a mobile app. We’re a Florida chartered bank with locations throughout the state to serve you. Call us at 888-577-0404 to open an account.

Disclaimer: The information contained herein is for informational/educational purposes only. The views and opinions expressed in this document may be those of the individuals and may not necessarily reflect those of Cogent Bancorp and its subsidiaries and affiliates, or the entities they may represent. Content contained herein may be used in connection with the advertising and/or marketing of products offered by Cogent Bank or Cogent Private Wealth. The material is not intended to provide or substitute for legal, tax, or financial advice or to indicate the availability or suitability of any Cogent Bank product or service. You should consult with a legal, financial, tax, or other appropriate professional(s) for your specific needs and/or objectives before making any decisions.

The 2025 Atlantic hurricane season runs from June 1 to November 30.

Businesses should assess risk, inspect their property, review insurance policies, and create evacuation and communication plans. Having an emergency fund and backup documentation is also key.

Businesses should have both property insurance and flood insurance. Property insurance typically covers wind and rain damage, while flood insurance covers storm surge and rising water. Review your policy for anti-concurrent causation clauses.

Include backup drives, financial records, chargers, radios, flashlights, first-aid kits, hygiene products, food, water, and emergency contact lists.

You can find emergency shelters through the American Red Cross, The Salvation Army, or by texting SHELTER and your ZIP Code to 43362.

Businesses may be eligible for SBA disaster loans, including Economic Injury Disaster Loans and Physical Damage Loans. FEMA and DisasterAssistance.gov also offer resources after a federally declared disaster.