FDIC-Insured

- Backed by the full faith and credit of the U.S. Government

To report a lost or stolen debit card please call 407.545.2662 during normal operating hours. After hours, please call 1.800.500.1044 immediately or access www.visa.com

Our Bank Routing and Transit Number is: 063114661

You will be linking to another website not owned or operated by Cogent Bank. Cogent Bank is not responsible for the availability or content of this website and does not represent either the linked website or you, should you enter into a transaction. The inclusion of any hyperlink does not imply any endorsement, investigation, verification or monitoring by Cogent Bank of any information in any hyperlinked site. We encourage you to review their privacy and security policies which may differ from Cogent Bank.

If you "Proceed", the link will open in a new window.

You are leaving Cogent Bank and going to Cogent Private Wealth, a boutique advisory firm offering comprehensive financial planning and investment management services. Some of their products are NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY; NOT GUARANTEED BY THE BANK; and MAY LOSE VALUE.

If you "Proceed", the link will open in a new window.

Please note that by clicking on this email address, you are leaving the Cogent Bank website and accessing an external email platform. Cogent Bank has no control over the content of any communications contained within this platform and cannot be held responsible for any information exchanged. We caution users to be careful when sharing any personal or sensitive information via email, as it may be intercepted or misused by third parties. By using this email platform, you accept full responsibility for any risks that may arise from its use.

If you "Proceed", the link will open in a new window.

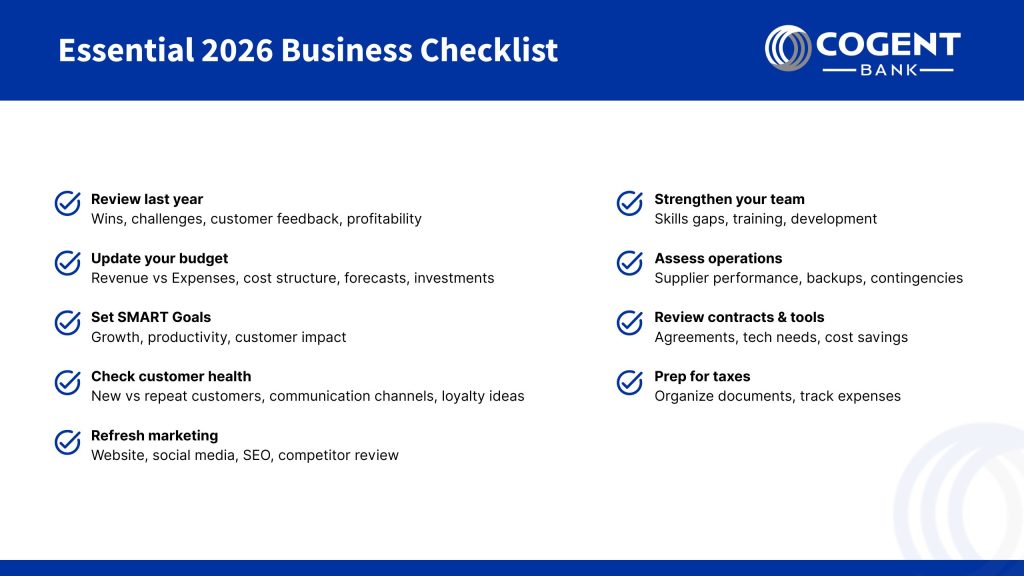

The start of the new year is a fresh opportunity for business owners to reflect on the past year’s achievements, learn from challenges, and strategically plan. This comprehensive checklist will guide you through a thoughtful review of your past year’s performance, help fine tune your budget, sharpen your goals, and strengthen your marketing and staffing strategies. By revisiting your successes and challenges, you can create a meaningful plan for the year ahead. With these steps, you’ll be well-equipped to make 2026 your most successful year yet.

Take a moment to look back on the past year with a clear lens. Understanding what worked and what didn’t is crucial for informed decision-making moving forward. Ask yourself:

Reflecting on these questions sets a solid foundation for your planning and helps you avoid repeating past mistakes while capitalizing on proven strategies. Don’t skip sharing your findings with your team to ensure they are part of the solution in the upcoming year. Be sure to celebrate your wins to boost your team’s morale and motivation.

A well-crafted budget is crucial in creating sustainable business success. Dive into your financials with care and pay close attention to detail:

By planning your budget carefully, your strategic goals become measurable, and you will be better prepared for any opportunities and challenges.

Goals that are unclear can lead to scattered efforts and missed opportunities. Use the SMART criteria to create goals that are Specific, Measurable, Achievable, Relevant, and Time-bound. Make sure your goals help achieve the success you desire in the short run but also keep your overall vision of your business in mind. Consider breaking down your goals into actionable objectives such as:

SMART goals provide clarity and focus, making it easier to track progress, adjust strategies as needed, and celebrate milestones that move your business forward.

Your customers are the heart of your business. Understanding their behavior and preferences helps you build lasting relationships and create effective offerings:

Regularly checking in on your customer base ensures you stay aware of any issues and that you are truly creating a loyal customer base.

Marketing drives visibility and growth. Take a critical look at your efforts to ensure they align with your business goals:

A strong marketing presence positions your business for sustained success and helps you connect effectively with your audience.

Your team’s capabilities have a direct impact on your business’s performance. Prioritize their growth to stay innovative and efficient:

Investing in your team not only improves productivity but also builds a positive workplace culture that attracts and retains key employees.

A strong supply chain is essential for smooth operations and customer satisfaction:

Managing your supply chain proactively helps safeguard your business against unexpected challenges, negative fluctuations in profit margins, and keeps your operations running smoothly.

Stay ahead by regularly reviewing your contracts and assets to ensure they support your company’s evolving needs:

This ongoing vigilance ensures your business agreements are still relevant and are supporting the current needs and goals of your business.

Avoid the stress of last-minute tax preparation by staying organized throughout the year:

Staying on top of your tax preparation saves time, reduces errors, and helps you take full advantage of available deductions and benefits.

At Cogent Bank, we’re dedicated to supporting the growth and financial health of your business. Whether you need expert advice on budgeting, treasury management, business lines of credit, or business deposit accounts, our team is here to help. Call 888-577-0404 or visit our Florida locations to learn more.

Disclaimer: The information contained herein is for informational/educational purposes only. The views and opinions expressed in this document may be those of the individuals and may not necessarily reflect those of Cogent Bancorp and its subsidiaries and affiliates, or the entities they may represent. Content contained herein may be used in connection with the advertising and/or marketing of products offered by Cogent Bank or Cogent Private Wealth. The material is not intended to provide or substitute for legal, tax, or financial advice or to indicate the availability or suitability of any Cogent Bank product or service. You should consult with a legal, financial, tax, or other appropriate professional(s) for your specific needs and/or objectives before making any decisions.